Table of Contents:

Existing Businesses with proper equity post closing

Existing business with negative equity or less than 10% BSE. Option 1: Inject Capital

Example #1: Enough BSE before closing, insufficient after closing

Example #2: Negative BSE with 10% injection required.

Next Equity Sections:

Equity Requirements for New Businesses without Construction

Equity Requirements for New Business with Construction

For many years the USDA used a unique eligibility test called tangible balance sheet equity (TBSE). This was different from shareholder equity over total assets in that you needed to remove the total intangible assets from the equation. While there were some positives to this metric, it confused many bankers, borrowers, CPA’s, and even the USDA itself. The confusion came from what is a tangible asset versus intangible. Many states and even the national office had their own definitions which frustrated banks and borrowers. This eventually came to a head with the publishing of a list of tangible and intangible costs in the old 4279 regulations. At the time, new construction projects would require 20% equity plus intangibles. These intangibles would routinely amount to 3-6% of the total loan which would push total equity to 23-26% of the project cost.

In the new OneRD(5001) regulations, the USDA removed the tangible aspect and elected to use only balance sheet equity (BSE), a simpler calculation for all parties involved. With this changed the USDA increased the equity required for construction only projects to 25%. While I am a fan of simplicity, the increase from 20-25% does hurt many borrowers who were below the 25% equity through the TBSE days.

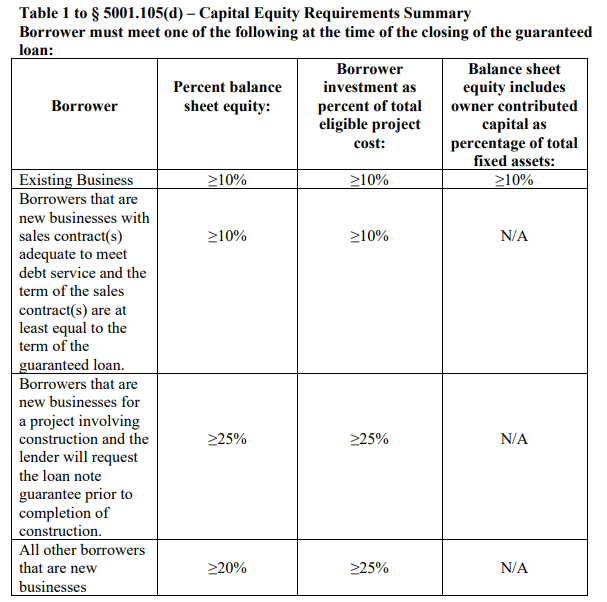

The New Balance Sheet Equity Grid

The grid below is taken from 5001.105(d) and shows the possible options for financing. Each section is broken up into three separate rules for how equity can be calculated. Some of these rules have further rules as it applies to standby debt or other financing, grant, or equity sources.

Refinancing and existing businesses saw little change to the 10% required equity. The exception is for the addition of two more options should there be negative shareholder equity on the balance sheet.

Existing Businesses with proper equity post closing

If your project an existing business and need a loan to refinance debt, purchase replacements, equipment, or make renovations the new USDA 5001 regulations are fairly straightforward when it comes to BSE eligibility however the refinance rules could make life difficult. If your business has 10% shareholder equity as defined by shareholder equity divided by total assets post closing then it will have passed this eligibility test.

Existing business with negative equity or less than 10% BSE. Option 1: Inject Capital

If you are an existing business but have negative shareholder equity or equity below the 10% threshold as defined above, one possible way to overcome this is to inject capital into the business to bring shareholder equity to the 10% level or inject 10% to the proposed project if equity would be negative. Note this is based on the post-closing balance sheet which will include closing costs, new equipment, or renovations as requested in the loan.

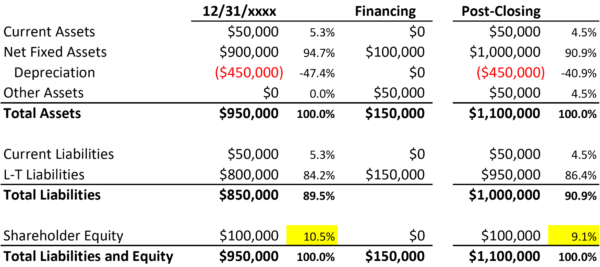

The image below shows the difference in cash injection needed based on the current balance sheet and post-closing balance sheet. As you can see, there is an increase in capital needed. Don’t fall into this trap of telling customers they need one number then surprising them at closing with another.

A tip here is to use borrower injected capital to pay for closing costs and other shorter term items so you can maximize the total term of the loan. In most cases this will be closing costs, then equipment, then CRE or renovations.

Keep in mind this is also based on a post-closing balance sheet and closing transactions must be taken into account when calculating this number. Just because the current balance sheet shows sufficient equity does not mean the post-closing balance sheet will so be careful when filling out your pro-forma post closing balance sheet.

Example #1: Enough BSE before closing, insufficient after closing

As you can see below, the borrower started with sufficient equity on their balance sheet however after factoring in the financing of $100,000 in renovations, $50,000 in closing costs, and refinance of the existing $800,000 loan, their BSE is 9.1% which would require additional capital to be injected. Capital should be applied to the loan proceeds thus lowering the loan so injection is only $10,000 instead of $11,100. While this is a minimal difference in this example, when loans get to $20MM+ these small differences can become a big deal.

Example #2: Negative BSE with 10% injection required.

This example, using the same debt proceeds, shows what would be needed if the borrower accelerated depreciation and reported losses and thus negative shareholder equity (retained earnings). It would require a $95,000 injection. In this case, the rules read 10% of the project so there is no funny math from injecting into the project to lower the loan or injecting into the balance sheet. While the USDA will place a covenant to limit distributions, the injected cash could theoretically be distributed back to the owner post closing. While this may trigger a technical default within the financial covenants, the lender would only need to discuss with the borrower about the violation and show the business was profitable and the borrower performed as agreed on other metrics when asking for a waiver.

I believe many states would want to see the capital injected into the loan and not on the balance sheet to keep this temporary infusion from happening.

The borrower may not need to inject capital based on the next rule.

Existing Businesses with negative equity or less than 10% equity. Option 2: Owner Contributed Capital

Another test for existing businesses that have less than 10% BSE is to show where an owner has injected capital at any point in the business equal to 10% of the fixed assets plus depreciation. Note, this says FIXED ASSETS PLUS DEPRECIATION and not total assets! Big plus here as businesses with large AR, Inventory, or Goodwill balances will come out easier.

In my opinion verification could be difficult as we will need to show money coming from the owner and being deposited into the business which will take canceled checks or bank statements showing money being moved. If property or other assets are being injected into the business, that transaction could add some complexity to determining eligibility without some kind of paperwork detailing the transaction. Sometimes, if equity is just under 10% of total assets, it may fit this calculation so having a good spreadsheet will help considerably.

Example #1 from above under this rule.

While the borrower only needed to inject about $10,000 to be eligible, if they could show where $135,000, $900,000 in net fixed assets plus $450,000 in depreciation times 10%, has been injected into the business in owner capital since inception, there would be no requirement to inject additional capital.

For underwriting and submission for USDA Approval, it would be smart to include a table of injected capital, date, and source with supporting bank statements and/or canceled checks to support this conclusion.

Example #2 from above under this rule.

The owner injected capital method impacts financing greater in this scenario where the borrower would need to inject $95,000 to make this loan happen. Since they are asking for $100,000 plus $50,000 in closing costs, they are almost funding the renovations and closing out of pocket. Most borrowers would think twice about taking down the new debt unless the USDA loan would put them on better rates/terms and the payback would be worth it. Showing the same $135,000 capital infusion would be in the borrowers favor here.

Thoughts:

- What is keeping a borrower from distributing existing cash from the business balance sheet and then injecting it back into the project as “owner contributed capital” to obtain the 10% metric? I would imagine this would be a small set of total projects where this would actually work. Adding distribution rules would be self-defeating as this would require state specialists to understand how distributions are accounted for and the difference in distributions and guaranteed payments and would make the process harder and thus more frustrating for the banks and borrowers participating in the program. Where businesses have negative equity but are cash heavy, this could be a viable option if there is sufficient time to work the balance sheet properly.

- What constitutes “equity”?

- Does sweat equity or injected goodwill count as equity? A business partner contributes an operating business for ownership in the larger group. That business has a going concern and the property and goodwill are booked at FMV on the balance sheet for equity in the business. Once again, propbaby a small set of total projects so maybe not a big deal.

- The regulations do not define owner-contributed capital or the method for verification. Does this mean the bank gets to decide what is acceptable verification? Does the USDA have any say-so during their review of the loan for approval to change the verification method? I would imagine it would go back to “prudent” banking practices as stated by the National Office on repeated occasions.

Equity Increases or Reductions

Finally, note that the USDA has the discretion to raise or lower the equity requirements pursuant to 5001.105(d)(5)(i-ii) should the proposed project present enhanced risk or exceptional risk mitigation. While I have never seen the USDA reduce equity requirements, I have encountered some projects where the USDA required additional equity, personal or corporate guarantees, or higher discounts on collateral to offset some kind of operational, economic, or project risk.

USDA 5001.105(d)(1) Snippets

(1) Existing businesses must meet one of the following requirements:

(i) A minimum of 10 percent balance sheet equity (including subordinated debt when subject to a standstill agreement for the life of the loan), or a maximum debt-to-balance sheet equity ratio of 9 to 1, at loan closing;

(ii) A 10 percent or more of total eligible project costs, borrower investment of equity or other funds into the project including grants or subordinated debt when subject to a standstill agreement for the life of the loan;

(iii) Balance sheet equity includes owner-contributed capital of ten percent or more of total fixed assets (net total fixed assets plus depreciation.)