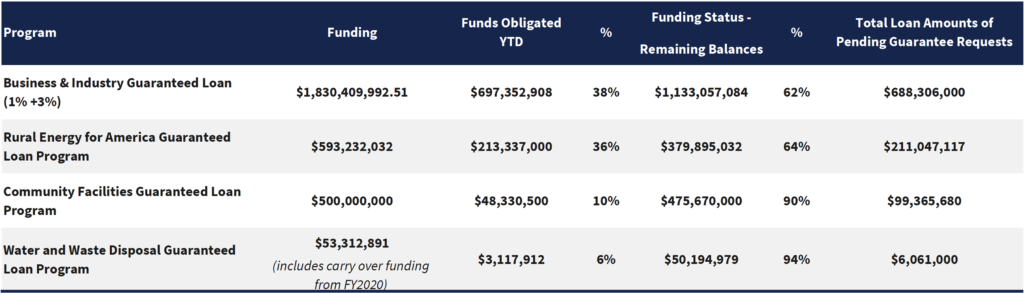

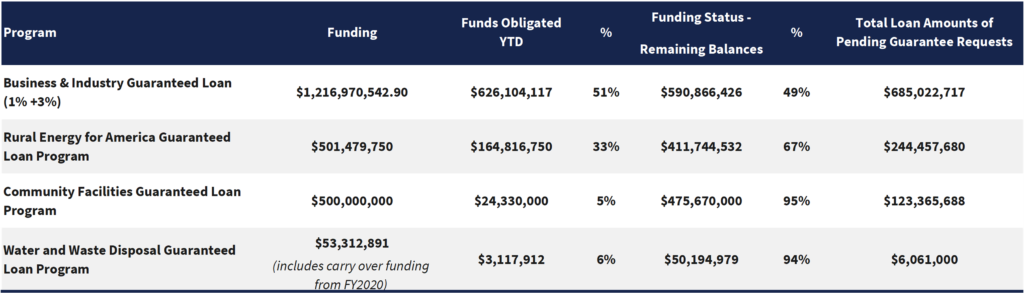

There is a new graphic on the OneRD website tracking total funding, utilization, and remaining funds. Over the last few weeks, this graph has shown over utilization of funding in the USDA’s Business and Industry (B&I) loan program. On the 3/31 update, $600,000,000 in funding was added to the B&I program to increase the total funding to over $1.8 billion.

While the additional funding is a great thing for lenders and borrowers, the lack of funding over the long term is a major concern for lending institutions across America. The B&I loan program had a $1.2 Billion budget for loans in this FY representing a small increase from last year. With the major changes in the new 5001 regulations, mentioned here, it is no surprise that funding is tight already.

To take advantage of these new regulations, many lending are pulling in loans that were not eligible in 2020 and 2019 and pushing them through the process. I believe there are a few direct issues impacting funding and provide some solutions to those issues in this post.

Funding and Program Recognition

Rural Development has received little attention from Congress or the President regarding the funding and staffing concerns brought up by many lenders over the last several months. SBA continues to receive billions in funding for their borrowers, staffing, and loan program. The lack of program recognition at the national level is hurting lenders and borrowers meet the needs of rural businesses when there are funding issues.

OneRD Changes Impacting Funding

As expected, the relaxation of the USDA regulations regarding Tangible Balance Sheet Equity, Loan Guaranty Levels and the Multi-State Lender program have created funding issues based on the $1.2Billion in B&I appropriations ($1.8Billion as of 3/31), detailed below.

Loan Guarantee Levels

The largest impact to funding is the blanket 80% loan guaranty up to $25MM on the B&I loan program. As expected, the average loan size for B&I has ticked up with large loans over $10MM benefitting the most with a 20% reduction in risk to the lending institution. As a lender myself, this rule change has been great and has opened up larger projects to funding that would have posed too much risk under the 4279 regulations and the old guarantee tier system. I would imagine most lending institutions are dredging up old projects and pushing them through the pipeline.

Tangible Balance Sheet Equity

With the Tangible Balance Sheet Equity requirement being replace by the Balance Sheet Equity Matrix, several funding opportunities have opened up that were once DOA due to negative Shareholder Equity on the borrower balance sheet. While these may not be increasing the average loan size, they are contributing to the overall utilization of funds in this FY. I would predict this trend to continue and have no issues with the delta this is causing in funding, especially after COVID when most businesses are going to show heavy losses.

Multi-State Lender

The “Multi-State Lender” designation created by the new OneRD regulations allows for lenders who complete 3 loans in non-contiguous states to submit loans directly to a USDA representative at the National Office and one a single point of contact for their lending instead of one at each state. This program is fantastic for lending institutions who want to leverage a single point of contact to complete their loans. While the program concept is a fantastic fantastic thought, the staffing for this program is lacking and many loan requests are being sent back to the states for processing thereby defeating the purpose of the program. Additional funding will be needed to add national staff to make this program successful and smoother for those USDA RD power users.

My Thoughts

I believe the majority of the changes enacted by OneRD are positive for the lending experience and for rural America. There are two items that I believe could have improved upon. First, the impact created by the changes in both the BSE requirement and increase loan Guarantee for $5MM and $10MM+ levels would have on the total utilization of funds was not well researched and should of lead to and increase in the overall increase in the funds available for guaranty. The second is the personnel needed to service the increase in loans and lenders brought on by the expanding lending guidelines.

While some of the funding issues are likely due to lenders reaching out to old contacts to dredge up loans that were not eligible before 10/1/2020, I expect that increase lending levels will continue into the future unless the USDA tightens up lending regulations. I would hate to see that happen as the projects being created with these funds are created good jobs in rural America.

Examples of Possible Future Lending Regulation Changes

1. Make sure that B&I loans create or save direct jobs and make that a pivotal point of the loan package.

Many loans under B&I have minimal job creation or retaining capabilities. If the purpose of the program is to create opportunities in rural America, then the USDA should make jobs or jobs to loan a metric to score loans or for loans to be eligible. I do understand that the financing of a strip center, for instance, does create indirect jobs, we should limit funding to those projects with minimal job creation abilities.

2. Reduce the Maximum Loan size from $25,000,000 to $15,000,000 keeping the 80% Guaranty.

I do not believe this will have a major impact on overall fund availability. A separate branch of this thought could be to reserve funds for projects less than $5,000,000 and projects from $5,000,000 to $10,000,000.

3. Allow for a partial unsecured portion of a business acquisition loan, for goodwill, with the receipt of a Business Valuation.

Business Acquisition is a vital part of rural America as many citizens living in those areas are beginning to retire and will need to pass on that operating business to a younger generation. Right now, unsecured loans are virtually impossible to approve though the USDA B&I program. I would like to see Bus Acquisition loans have special rules what allow them an unsecured amount if they create or save jobs or have a job to loan ratio of a certain level. Capping the total LTV to 125%, say, or some other number could be helpful as well.

4.Change environmental requirements to align with other governmental funding platforms.

The intergovernmental review and environmental report requirements on several loan types are killing projects in rural America due to the time and money it takes to complete these items. I do understand the necessity of these reports, but some efficiency needs to be gained in make these reports quicker to receive and thus cheaper for the borrower.

5. Set a max funding level for any one guarantor, like the SBA’s $5,000,000 level for any one guarantor.

I would imagine a $50,000,000 for any one guarantor would suffice as any more would probably mean they can find funding elsewhere.

Leave A Comment